18/01/2023

U&I Logistics - More than half of logistics managers surveyed by CNBC do not expect the supply chain to return to normal until 2024 or after.

More than half of logistics managers at major companies and trade groups say they do not expect the supply chain to return to normal until 2024 or after, according to a new CNBC survey.

Sixty-one percent of respondents said their current supply chain is not operating normally, compared with 32% that said it is functioning normally. When questioned when they see a return to normalcy, 22% were unsure, 19% said 2023, and 30% said 2024.

Another 29% said in or after 2025, or never.

The dour outlook comes after almost three years of global supply chain problems, which began with the shutdown of Wuhan, China, where the Covid outbreak began. Survey respondents said they are still placing orders six months in advance to ensure their arrival.

The survey questioned 341 logistic managers the week of Dec. 12-19 at companies that are members of the National Retail Federation, the American Apparel and Footwear Association, the Council Of Supply Chain Management Professionals, the Pacific Coast Council, the Agriculture Transportation Coalition and the Coalition Of New England Companies For Trade participated in first supply chain survey by CNBC.

Nate Herman, AAFA’s senior vice president, of policy told CNBC the problems that created the supply chain crisis are far from over.

“Now is the time to double down on bringing all stakeholders together to create and implement real solutions to structural problems so that we don’t end up skipping from crisis to crisis,” he said.

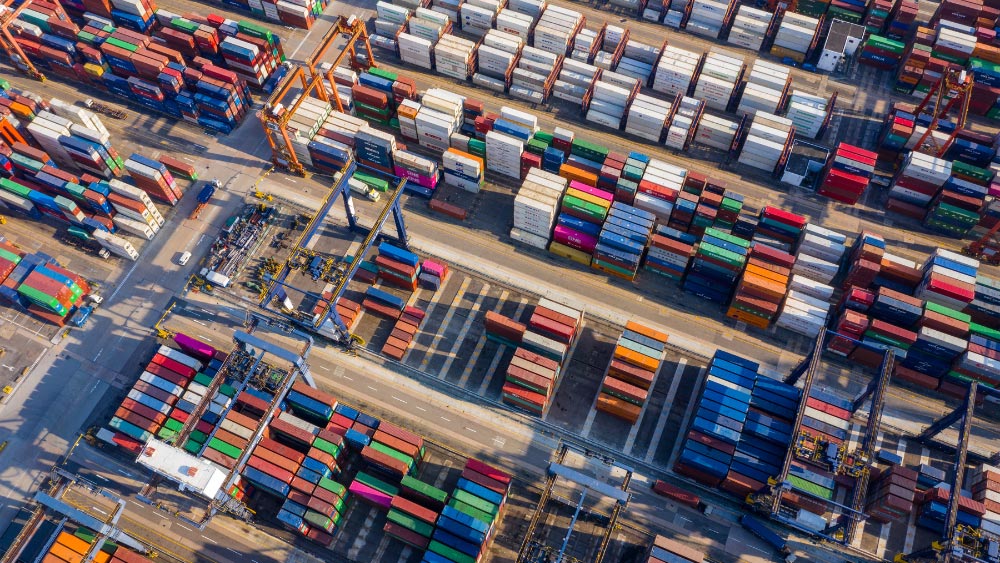

Among the biggest challenges cited by logistics managers noted in the survey were the lack of availability of raw materials, port congestion, a lack of skilled workers and dwindling warehouse space because of soaring inventories. Also cited were terminal rules on picking up and dropping off containers, late container fees (Detention and Demurrage), and canceled sailings.

Bloated inventories have kept warehouses packed, and respondents said they saw a 400% increase in warehouse prices as space decreases. That is benefiting consumers, with who are picking up heavily discounted items as retailers try to move out product out of the warehouses.

Scott Sureddin, CEO of DHL Supply Chain, said freight volumes were flat after Cyber Week but are now up 10% from a year ago as retailers slash prices to clear inventory.

“Customers are shopping discounts and we are seeing that in the items we are moving. It’s the higher value products like tennis shoes over a lower cost t-shirt, he said. “I have never seen inventory levels like this and after the first of the year, retailers can’t continue to sit on this inventory so the discounts they’ve been pushing will have to continue.”

Energy prices and labor are two inflationary pressures respondents said are still driving up logistic costs. Russia’s war on Ukraine followed by tariffs imposed during the Trump administration were the top geo-political events impacting the supply chain, followed by Covid.

On the labor front, respondents said they were worried about the mental health of their workforce as well as the shortage of skilled workers, which is adding to the stress. Survey results cited these as problems: employee burn out (65%), shortage of employees with the right skills (61%) and hiring to address the skills gap (75%).

“International logistics is still a business driven by people,” said Kenney of CONECT. “The survey highlights all sorts of challenges in the supply chain, but none of those will get solved without the right talent and expertise.”

Source: CNBC

U&I Logistics

.jpg)

26/01/2026

30/12/2025