11/07/2024

U&I Logistics - In import-export business operations, one of the critical and relatively complex steps that every business must undertake is the customs clearance process. This is a key procedure to ensure goods are smoothly cleared and comply with all legal regulations. Let U&I Logistics guide you through the detailed export customs procedures process in the article below!

Customs procedures encompass tasks that importers, exporters, and customs officials must complete under legal regulations for goods and transport vehicles involved in import, export, transit, re-importation, and re-exportation. With specific rules for each type of import-export activity, goods category, and vehicle crossing borders, customs procedures are integral to the customs operations of any import-export process.

As international trade grows, customs procedures have been simplified to enhance goods circulation while ensuring national security, protecting domestic markets, and promoting international trade. Consequently, companies involved in import-export must strictly adhere to these customs regulations

What are customs procedures?

Customs procedures play a pivotal role in the success of businesses, especially those in international trade. Here are some key reasons:

a. Compliance and Risk Avoidance:

- Avoiding Violations: Proper customs procedures enable companies to comply with the law, avoiding legal risks like fines, goods confiscation, or even criminal prosecution.

- Building Trust: Adhering to customs regulations strengthens a company's reputation and trustworthiness with partners and regulatory authorities.

b. Time and Cost Optimization:

- Quick Clearance: Efficient customs procedures facilitate faster goods clearance, minimizing storage time, warehousing costs, demurrage fees, and other associated expenses.

- Taking Advantage of Incentives: Understanding customs regulations allows businesses to benefit from tax incentives and trade policies, enhancing competitiveness.

c. Risk Management and Safety Assurance:

- Quality Control: Customs procedures involve quality checks to help businesses prevent counterfeit or substandard goods from entering, protecting both the brand and consumers.

- Security: Customs procedures contribute to national security, preventing smuggling and the transportation of prohibited goods.

d. Market Expansion:

- Access to International Markets: Customs procedures are essential for export-import permissions, helping businesses expand into global markets and reach international customers.

- Boosting Competitiveness: Mastering customs procedures gives companies a proactive approach in international trade, enhancing their competitive edge globally.

With technological advancements, e-customs has emerged as an optimal solution for companies. Instead of filing physical declarations, businesses can now submit information electronically through popular e-customs software like ECUS5-VNACCS, FPT.VNACCS 278, and ECS 5.0. This transition reduces processing time, minimizes manual steps, and prevents errors commonly found in direct reporting.

Businesses simply need to enter information on the software per regulations outlined in Appendix I of Circular 39/2018/TT-BTC dated April 20, 2018. All e-declarations and accompanying customs documents are electronically transmitted to the relevant e-Customs Sub-department, where the VNACCS/VCIS system automatically processes them, providing further guidance to companies.

In cases where technical issues prevent electronic submission, businesses may submit physical documents temporarily and later upload them as instructed by customs authorities. E-customs minimizes labor costs, enhances accuracy in declarations, and enables companies to track file processing and cargo information, facilitating more efficient import-export planning.

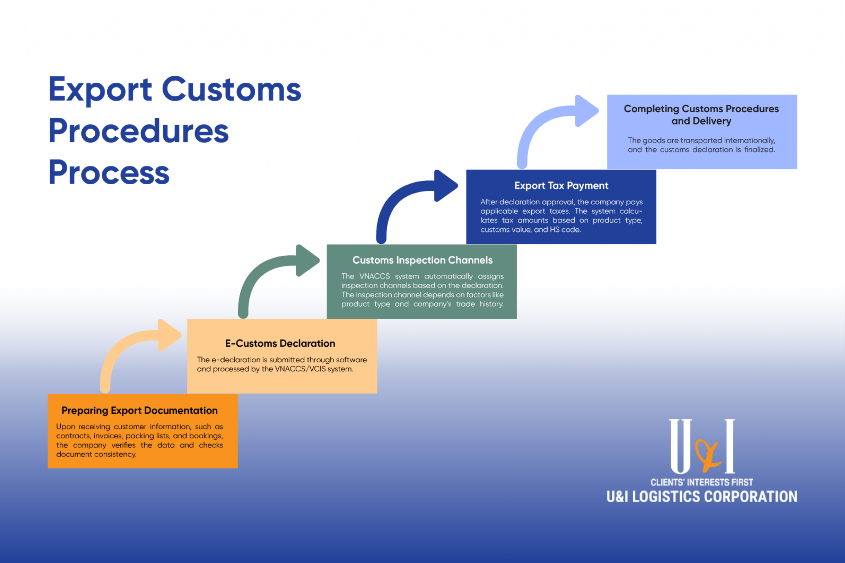

The export customs procedure involves several steps, which can vary based on the type of exported goods. However, the standard procedure for export customs clearance generally includes five steps:

- Sales Contract

- Packing List

- Commercial Invoice

- Booking Confirmation

Proper preparation ensures smoother customs declarations, saving time and minimizing potential issues.

- Green Channel: Immediate clearance without checks; companies pay customs duties and proceed.

- Yellow Channel: Additional documentation for review by Customs.

- Red Channel: Comprehensive documentation review and physical inspection.

The inspection channel depends on factors like product type and company’s trade history.

U&I Logistics’ Comprehensive Customs Brokerage Service

With extensive experience in customs brokerage across all types of imports and exports, U&I Logistics provides businesses with the best solutions for customs procedures. U&I Logistics is known for its precision and quick processing times.

Additionally, U&I Logistics offers related services, including warehousing and distribution, domestic and international transportation, and both sea and air freight. With a standardized import-export process, U&I Logistics confidently meets all customer needs.

With the trust of our clients, U&I Logistics processes hundreds of thousands of customs declarations every year. We are committed to continuing our efforts to deliver the best solutions for all partners in international trade.