18/02/2022

U&I Logistics - Vietcombank Securities (VCBS) has recently released a report on the prospect of the Port - Logistics industry in Vietnam in 2022. Accordingly, the growth rate of the Logistics industry in 2022 is expected to increase sharply in order to recover after the Covid pandemic. The following are detailed information about the prospect of the Seaport - Logistics industry in Vietnam in 2022, compiled by U&I Logistics from the report of VCBS.

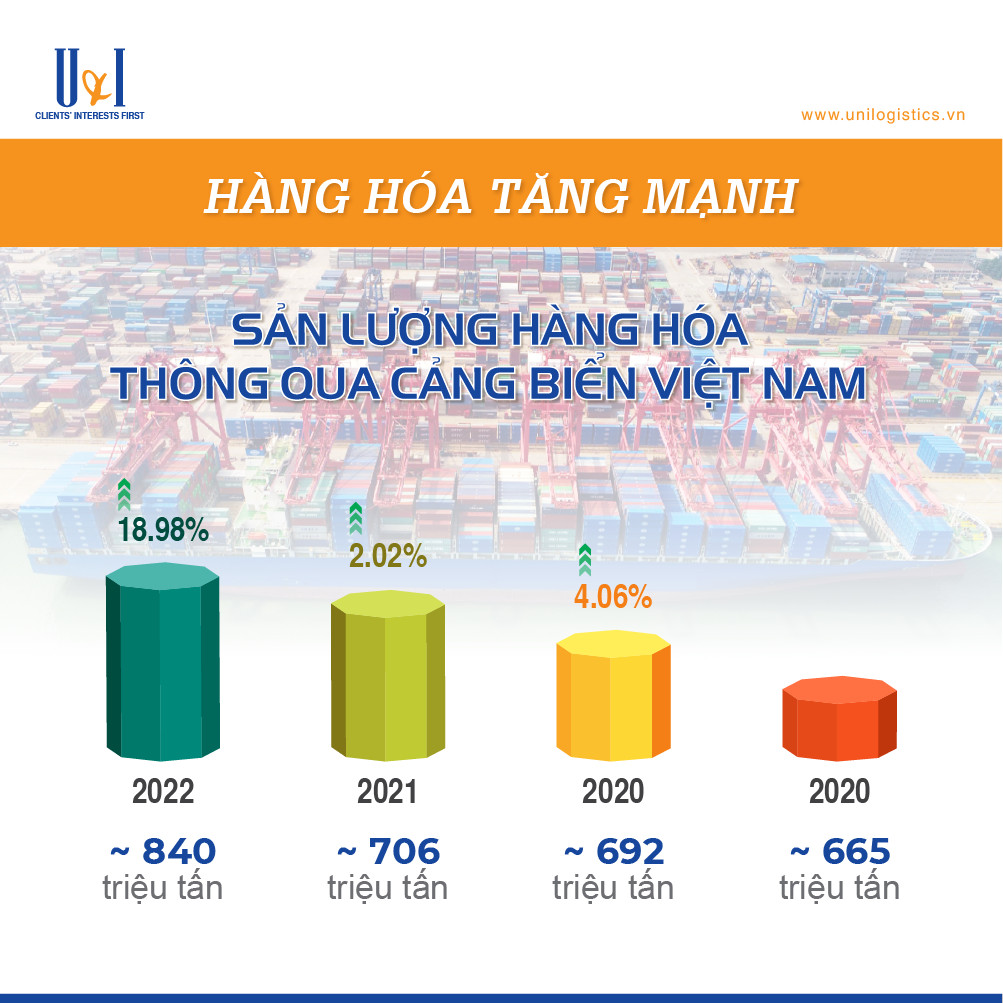

In 2022, cargo throughput through seaports is forecasted to maintain positive growth and reach 840 million tons (+19% yoy) thanks to the following factors:

Firstly, the population covered by vaccination has been stable, especially in big cities across the country.

Second, production and circulation of goods are restored and it is unlikely that there will be another large-scale blockade in 2022, although the transmission may not be completely stopped due to:

Changes in the government's anti-pandemic strategy towards living with the pandemic

Lessons from the fourth outbreak show that blockades to completely cut off the source of the disease are ineffective against fast-spreading variants, causing a great deal of economic damage.

Third, the reduction of ocean and sea freight rates would bring great motivation to export activities in 2022, especially groups of aquatic products, agricultural products, and wood products.

Growth in cargo volume would be most evident in the second half of 2022 because this is the peak season of the year. At the same time, due to the impetus from new investment projects and production expansion, many FDI enterprises would go into operation after a stagnation in 2021 due to the pandemic situation.

Container freight rates are forecasted to cool off in 2022 along with congestion at seaports and improved cargo movement as countries gradually achieve herd immunity and high vaccine coverage. The approach to living with pandemics is increasingly common occurrences and accepted in many parts of the globe.

High freight rates and the oligopoly of liner shipping companies in the world have greatly affected the interests of customers in trade. Some big shipping companies such as CMA CGM and Hapag-Lloyd have cut freight rates under pressure from governments and important customers. Large retailers (such as Walmart, Costco, Home Depot,...) have bought containers and built their own fleet to serve freight transport.

However, container freight rates would hardly return to low levels in 2022 when large centers, especially located in Asia with a large population (such as China, India, etc.). ) would need more time to achieve herd immunity. Not to mention, China continues to pursue the Zero Covid strategy (completely eliminating the source of infection in the community) through blockade measures and the supply of new-built container ships would only begin in the handovers from 2023.

Compared with container cargo, bulk freight shipping rates are likely to witness a faster decline because the shortage of raw materials is no longer so acute thanks to the gradual resumption of the supply chain of basic goods. Governments take measures to prevent speculation, manipulate prices and release stockpiles to stabilize commodity prices. Unlike the loading market, the bulk shipping market is quite fragmented and transport enterprises do not have relative power in regulating and controlling the market.

The demand for cargo services has increased sharply in Cai Mep area while most of the seaports in the deep-water ports in the downstream Cai Mep area have basically reached the designed capacity. The characteristics of the downstream ports Cai Mep create a monopoly position with only 3 main developers (Tan Cang, Vinalines, and Gemadept) and often have joint venture ownership of large shipping lines. Therefore, the pressure of operating beyond design capacity at ports still exists when shipping lines give priority to using the services of ports with beneficial relationships.

This creates a great demand for the ICD system/cargo consolidation point as an extension of the Cai Mep deep-water ports, helping to save time in handling and customs clearance of goods and release capacity at ports. The outstanding advantage in becoming an extension of a deep-water port belongs to ICDs because these units have been included in the list of inland ports or in the lists of having great potential to be recognized as inland ports in the near future. ICDs have an ownership interest in the deep-water port operator at Cai Mep.

Logistics businesses/logistics centers are forecasted to continue to grow strongly in 2022 thanks to the explosion of the e-commerce market when the pandemic drastically changes people's shopping habits, thereby posing a great demand for logistics infrastructure and handling centers due to the maximized use of warehouse space and logistics compared to traditional trade channels. Not to mention, the increase in market share of retail companies (Bach Hoa Xanh, Co.opMart, Vinmart, ...) helps to boost the demand for warehouse infrastructure and logistics services.

The development of the seaport industry, in particular, has opened up a lot of growth opportunities for the Vietnam Logistics market this year. In addition to the above forecasts, shipping enterprises gradually establish a new profit base in the coming period. Moreover, with increased cargo volume, downstream ports will grow strongly again.

U&I Logistics