08/06/2022

U&I Logistics - According to predictions from ocean shipping company, forwarders and many other companies, port congestion in the US will get worse before returning to its peak.

The drop in consumer spending has hit retailers hard as orders from Asia drop significantly. This is a widely discussed topic, they expect revenue to grow again and need support to get the business back on track. However, the reduction in spending at times will translate into flexibility in supply chain operations. The assessment made by many in the industry is that cargo traffic is now slowly getting worse, with any support going away until the end of the year, if not longer.

Dominique von Orelli, DHL Global Forwarding Executive Vice President and Global Head Of Ocean Freight, said: “We see this year as going to be a challenging year, with schedules likely to drop slightly in the second half. year-end, but reliability remains very low for the rest of the year.”

According to IHS Markit data, it is possible to reduce imports from Asia in the future. In which, import volume increased by 31% in the first four months of 2022 compared to the same period in 2019. The challenge is keeping up with the volume that has moved through the supply chain.

Inventories have grown significantly since the end of last year, as evidenced by an increase in imports in the first quarter. Containers stay longer at seaports, and retailers' inventories also climb, choking supply chains. This results in ships, containers and chassis not working, which is a pain to resources in both ports and inland railways even during peak import season.

A major ocean shipping company has specifically identified its growing alertness. The problem they face is that the time it takes shippers to pick up imported containers is increasing rapidly at ports and railways, in addition to the time it takes to return containers to carriers. Instead of unloading at the warehouse and returning the container, many customers ship unopened containers outside of distribution centers for long periods of time and incur high storage fees. The carrier said that over the past month, the average number of days its containers are off the road nationwide has increased by more than 50%, from eight days to more than 12 days. In Chicago, the time was increased from 21 to 26 days, in Kansas City from 5.5 to 9.2 days, and in Savannah from 8.1 to 10.1 days.

These figures explain why incidents are such a concern in the rail intermodal network. Similar to what happened last summer, the airline's domestic terminals were full of containers and could not handle more cargo coming in from the ports when Union Pacific Railroad suspended intermodal service off the West Coast.

According to the Pacific Merchant Transit Association, rail stop times at Los Angeles-Long Beach have increased from about 3 days in December 2021 to more than 9 days in April 2022. Behind those figures is the inventory build-up by retailers this year. This is in part due to a series of supply chain disruptions since late 2000, including specific factors such as the risk of labor disruptions on the West Coast.

The clothing retailer's inventory at the end of May was 45% higher than in the first quarter of the year, said Fran Horowitz, CEO of Abercrombie & Fitch. “The reason comes from diversifying carriers and ports of entry, adjusting the company's product schedule, and diversifying into more countries. We hope these collective efforts will lead to more predictable inventory flows,” said Fran Horowitz.

“As supply chain disruptions continue, we have extended our inventory lead times and are holding more inventory than usual, ensuring there is always enough inventory to protect sales.”

Chief Financial Officer Melanie Marein-Efron said during a call.

That inventory build-up, as evident in the recent financial statements of Ralph Lauren, Kohl's, BJ's, Target, Walmart, The Container Store, Fossil, Yeti, Wolverine, Party City and Dick's Sporting Goods, are directly affecting the supply chain.

At ports, imports piled up on the docks. According to the Georgia Port Authority, before May 23, nearly 28,000 imported containers were at the Garden City terminal, compared with an average of 12.000 in 2019 and 13.000 in 2020, but equivalent to the average of 27.000 containers of the previous year.

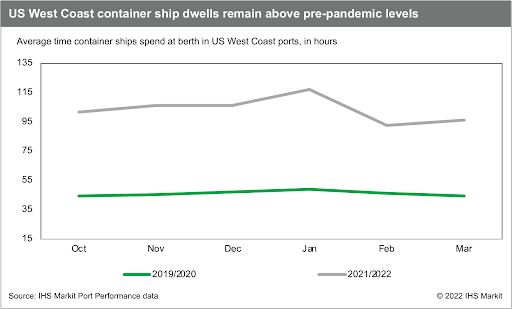

The increase in containers at ports is predictable with respect to the impact on the supply chain. “Despite modest signs of improvement, we are still seeing an increase in total docking and berthing hours at key U.S gateways”, said Deputy Head of Leadership Team Port Analytics at IHS.

U&I Logistics